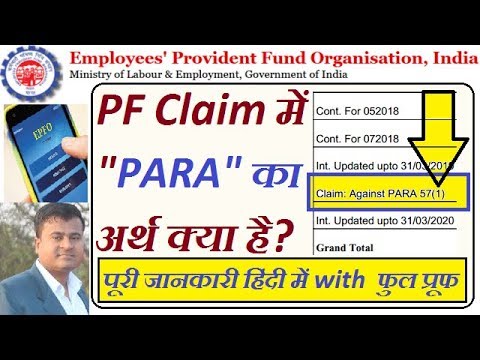

If its mentioned as Claim against PARA 571 it means the transfer is made from one pf office to another pf office for example MH Bandra to TH Thane office in. 111 PF Withdrawal in case of Natural calamity of exceptional nature Paragraph 68L.

Epf Interest Credited In Employees Pf Accounts Paisabazaar Com

Epf Interest Credited In Employees Pf Accounts Paisabazaar Com

Un-Exempted to Un-Exempted - Task Auto generation 2.

What is claim against para 57(1) in pf. Google has many special features to help you find exactly what youre looking for. Certificate from doctor employer no more required applicable wef. 50 Provident Fund Account 51 Interest Account 52 Investment of moneys belonging to Employees Provident Fund 53 Disposal of the Fund 54 Expenses of administration 55 Form and manner of maintenance of accounts 56 Audit 57 Inter-State transfer of members 58 Budget 59 Members Accounts 60 Interest CHAPTER VIII.

Exempted to Un-Exempted - Annexure K ONLY SERVICE 4. Dear Saral Team Please let us know the web-site URL where the online withdrawal process documentation is available and the link to the PF withdrawal online form. The Form should be submitted to that PF Officer under which previous or the present account is maintained depending upon as to which employer has attested the claim.

19 PF Withdrawal One year before Retirement Paragraph 68NN. 2 In case the PF. Application for Financing a LIC Policy out of the PF Account 17.

Form 19 Para 725. 25022016 In another change EPFO has made it mandatory to wait till attaining the age of 57 for claiming PF withdrawal for transferring that to the Life Insurance Corporation of India for. 27042017 At present the Employees Provident Fund Organisation EPFO subscribers can seek advance under Para 68-J of the EPF Scheme for their and their dependents treatment for illness.

EPF Form 31 is utilised to file a claim for partial withdrawal of funds from EPF or Employees Provident Fund. Search the worlds information including webpages images videos and more. 129 Responses to Claim settlement period for PF withdrawal is now just 10 days.

Intra office Same office PARA 572 1. Besides the physically challenged member can seek advance for purchasing equipment to deal with handicap under Para 68-N. Para 69.

09052020 In this case the three month Basic DA will be Rs 55000 x 3 Rs 165000 which is more than Rs 15 lakh. Un-Exempted to Exempted - Annexure K and payment through Cheque Trust 3. If its mentioned as Claim against PARA 571 it means the transfer is made from one pf office to another pf office for example MH Bandra to TH Thane office in.

1 To be submitted by the member to the present employer for onward transmission to the Commissioner EPF by whom the transfer is to be effected. 08042012 At this juncture Para 57 of the Employees Provident Fund Scheme 1952 comes into picture. It permits an employee to transfer his PF from his previous employer to the new employer whether located within the same region or in different regions if one of them is a covered establishment.

How to claim. Application for transfer of EPF Account 16. EPF or Employees Provident Fund is a government-backed savings option that can facilitate salaried individuals to build a significant corpus to.

Trust of an exempted establishment the. Hence you can withdraw Rs 150000. Transfer is due from the PF.

Viru Mhatre June 21st 2017. Exempted to Exempted - Annexure K ONLY SERVICE Inter office Across EPFO offices PARA 571 1. 112 PF Withdrawal for Physically handicapped.

Form for claiming PF dues 20. In case the claim is attested by the present employer claim should be submitted with the PF Officer under which the present account is maintained and so on. Form 14 Para 62.

Form 15 Para 641. 153 E issued in Feb 2016 stating the new norms for withdrawal of provident fund accumulation on cessation of employment has been withdrawn by the Ministry of Labour and Employment on 19th April 2016. Form 16 Para 68 B.

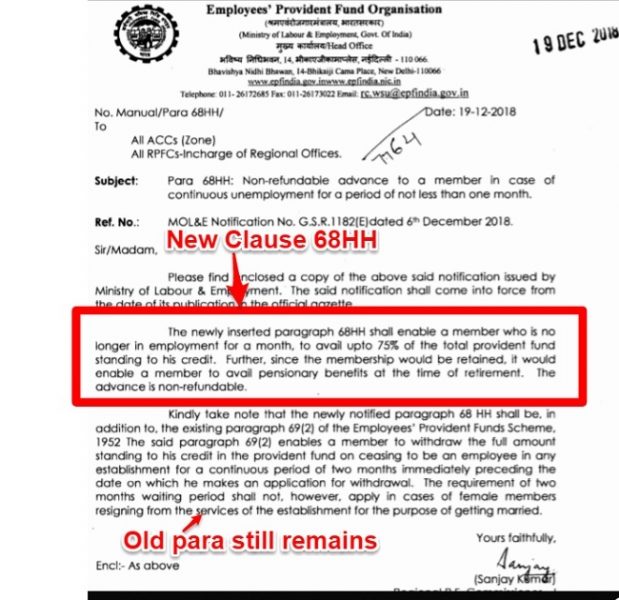

10012020 18 PF Withdrawal in case of Unemployment Paragraph 68HH. Vide this notification under para 68NN Withdrawal within one year before the retirement the age limit was increased from 54 to 57 years. Form of assignment of policies 18.

EMPLOYEES PROVIDENT FUND SCHEME 1952 PARA 57. The mobile number wherever provided of the member would be used for sending an SMS alert. THE EMPLOYEES PROVIDENT FUND SCHEME 1952 Para-57 APPLICATION FOR TRANSFER OF EPF ACCOUNT NOTE.

26042017 EPFO has notified the EPF Fifth Amendment Scheme 2017 and has amended the Para 68J Advance for Illness and Para 68N Advance for Handicap Support Equipments of the EPF Scheme whereby Members can avail advance based on self-declaration only ie. In case the claim is attested by the present employer claim should be submitted with the PF Office under which the present account is maintained and so on 4. Form 13 Para 57.

Application for advance from the Fund 19. 110 PF Withdrawal for Investment in Varistha Pension BimaYojana Para 68NNN.

I Have Left A Job And Now I Want To Withdraw Pf And Pension Amount That I Had Transferred To My Current Establishment How To Withdraw Pension Amount Of My Previous Employer

Eps Employee Pension Scheme Eligibility Calculation Withdrawal

Eps Employee Pension Scheme Eligibility Calculation Withdrawal

Epf A C Interest Calculation Components Example

Epf A C Interest Calculation Components Example

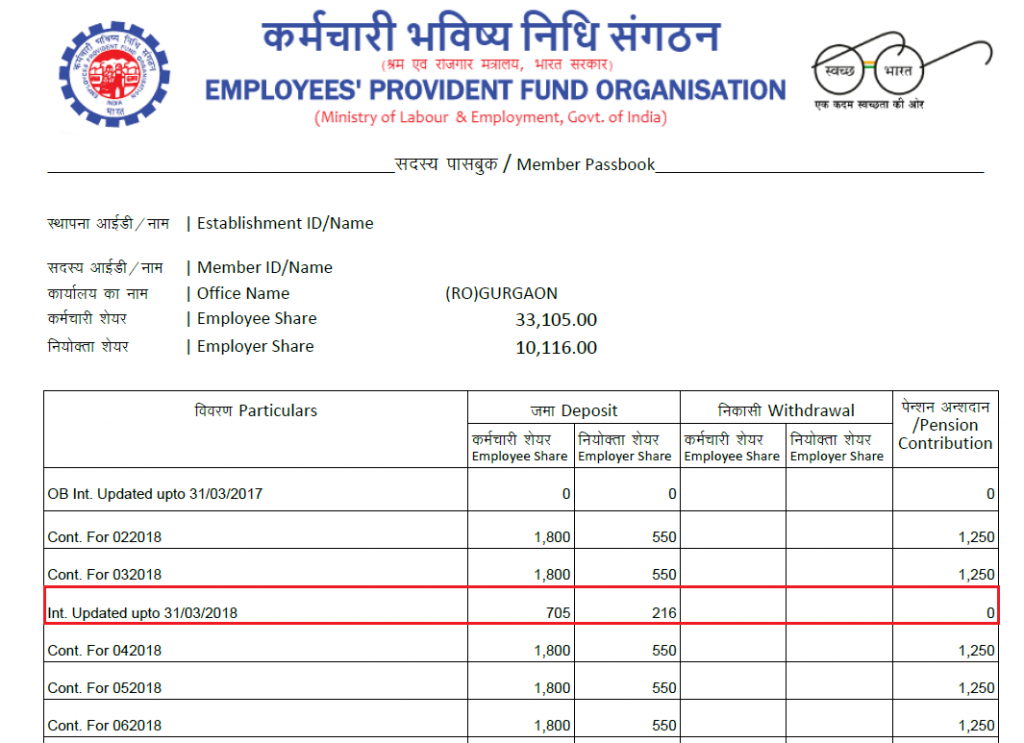

How To Read An Epfo Passbook What Is The Meaning Of Various Columns In There How Do I Calculate The Exact Amount I Have Quora

I Have Left A Job And Now I Want To Withdraw Pf And Pension Amount That I Had Transferred To My Current Establishment How To Withdraw Pension Amount Of My Previous Employer

How To Read An Epfo Passbook What Is The Meaning Of Various Columns In There How Do I Calculate The Exact Amount I Have Quora

How To Read An Epfo Passbook What Is The Meaning Of Various Columns In There How Do I Calculate The Exact Amount I Have Quora

How To Read An Epfo Passbook What Is The Meaning Of Various Columns In There How Do I Calculate The Exact Amount I Have Quora

Check Epf Balance Offline With Uan Number How To Check Pf Balance By Using Sms And Missed Call Youtube

Check Epf Balance Offline With Uan Number How To Check Pf Balance By Using Sms And Missed Call Youtube

How To Read An Epfo Passbook What Is The Meaning Of Various Columns In There How Do I Calculate The Exact Amount I Have Quora

I Have Left A Job And Now I Want To Withdraw Pf And Pension Amount That I Had Transferred To My Current Establishment How To Withdraw Pension Amount Of My Previous Employer

What Is Para Meaning In Pf Claims Youtube

What Is Para Meaning In Pf Claims Youtube

I Have Left A Job And Now I Want To Withdraw Pf And Pension Amount That I Had Transferred To My Current Establishment How To Withdraw Pension Amount Of My Previous Employer

Why Eps Pension Amont Not Transfer In New Pf Account Number Youtube

Why Eps Pension Amont Not Transfer In New Pf Account Number Youtube

What Happens To Eps When You Transfer Your Old Epf To New Employer

What Happens To Eps When You Transfer Your Old Epf To New Employer

Epfo On Twitter Kindly Submit A Physical Request In Joint Declaration Duly Signed By The Member And The Employer Along With Required Documents Duly Attested By The Employer In Respect Of Change

Epfo On Twitter Kindly Submit A Physical Request In Joint Declaration Duly Signed By The Member And The Employer Along With Required Documents Duly Attested By The Employer In Respect Of Change

I Have Left A Job And Now I Want To Withdraw Pf And Pension Amount That I Had Transferred To My Current Establishment How To Withdraw Pension Amount Of My Previous Employer

New Epf Withdrawal Rules 2019 Basunivesh

New Epf Withdrawal Rules 2019 Basunivesh