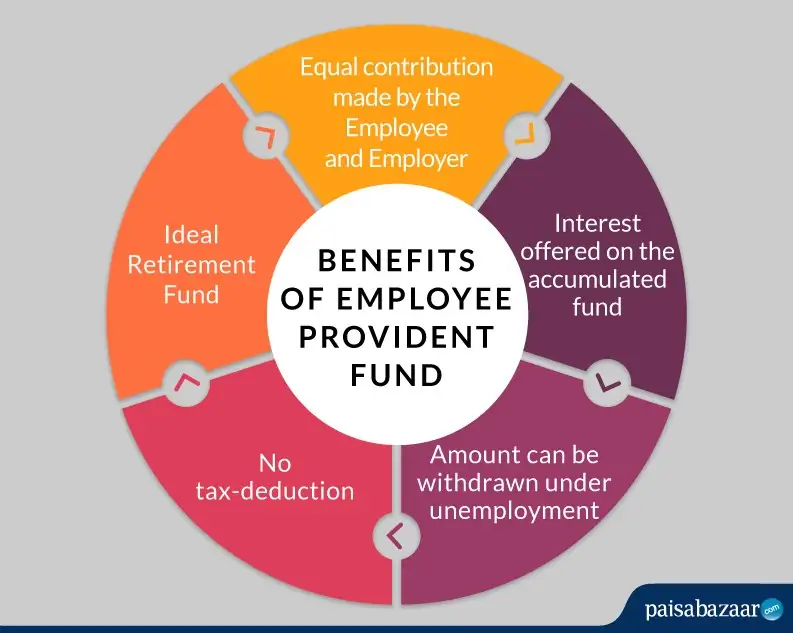

You can make EPF balance enquiry for past organizations as well as that from the current employer. Under EPF Scheme an employee and employer have to pay certain percentage of equal contribution in the provident fund account and on retirement.

The Employees Provident Funds Bill was introduced in the Parliament as Bill Number 15 of the year 1952 as a Bill to provide for the institution of provident funds for employees.

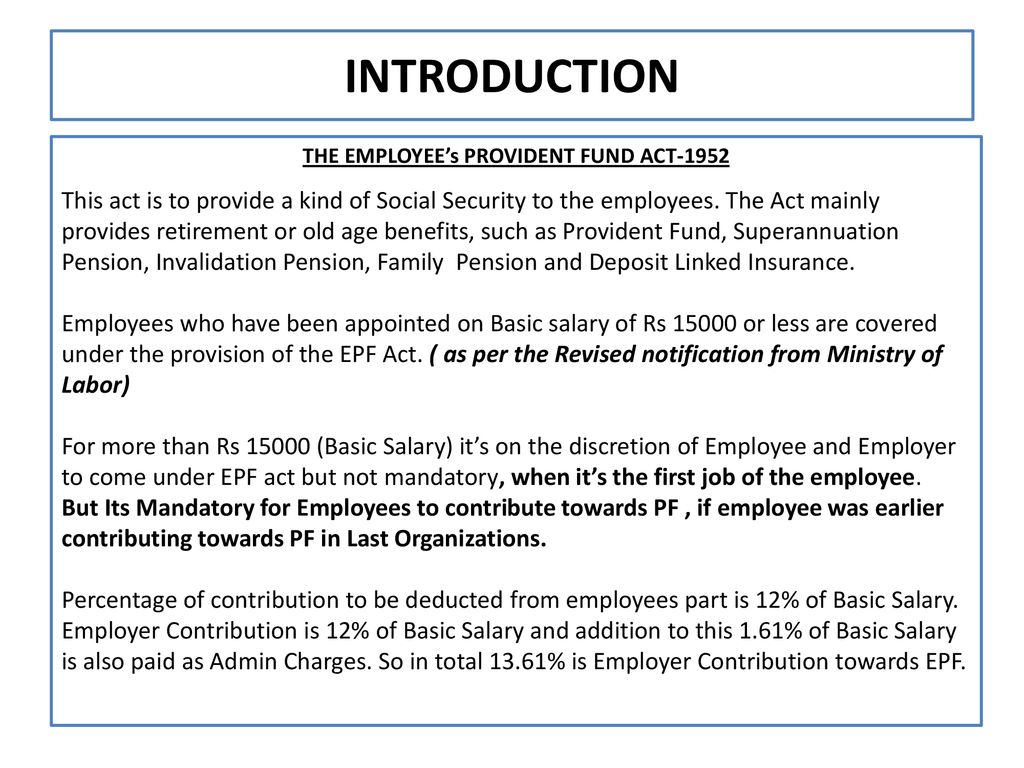

The employees provident fund scheme 1952 balance enquiry. EPF Balance Enquiry EPF Employees Provident Fund is a government saving scheme by the EPFO. 15000 then opening an EPF account is mandatory. 29112013 The Employees Provident Fund Act 1952 Calculation 12 contribution by the employee is directly transferred to his Provident Fund Ac 12 is contributed by the employer out of which 833 is credited to Employee Pension Fund and the balance 367 is transferred to PF Ac of the employee 110 Administration charges on total wages are payable by the employer 050 EDLI calculated on total EDLI slab Rs.

In this scheme an employee has to contribute 12 of their basic income towards the fund every month. About Employees Provident Fund Organisation. Exempted establishments are large companies like Godrej HDFC Nestle Wipro TCS Infosys etc.

30032020 According to the Employee Provident Fund and Miscellaneous Provisions Act 1952 some employers can manage their own PF schemes for their employees. Short title and application. Government Both State and Central.

6500 wages and payable by the employer towards EDLI fund. The EPFO came into existence with the promulgation of the Employees Provident Funds Ordinance on the 15th November 1951. That have in-house EPF trusts and are exempted from contributing their EPF corpus to the EPFO.

Employees Provident Fund Scheme EPFS is a long-term retirement saving scheme managed by Employees provident fund organization EPFO and it is covered under the Employees Provident Funds and Miscellaneous Provisions Act 1952. Implies section 3 to. 12042016 EPFO Online epf india enquiry Portal.

In exercise of the powers conferred by section 5 of the Employees Provident Funds Act 1952 19 of 1952 the Central Government hereby frames the following Employees Provident Funds Scheme 1952 namely. It was replaced by the Employees Provident Funds Act 1952. 28072012 The employee provident fund act NGOS 1952 implies to the whole of Considering the operations of India except the state of Jammu charitable institutions these.

The employer matches this amount with an equal contribution. Employees Provident Fund Scheme EPFS is a long-term retirement saving scheme managed by Employees provident fund organization EPFO and it is covered under the Employees Provident Funds and Miscellaneous Provisions Act 1952. Factory engaged in any industry specified in.

In exercise of the powers conferred by section 5 of the Employees Provident Funds Act 1952 19 of 1952 the Central Government hereby frames the following Employees Provident Funds Scheme 1952 namely. Kindly seed UAN accounts with KYC if not already done to view credit of interest and updated PF accounts. CHAPTER I Preliminary 1.

30032021 The Employees Provident Fund EPF is a savings scheme introduced under the Employees Provident Fund and Miscellaneous Act 1952. Kashmir section 2This act includes the following. Educational scientific research Every establishment which is a.

Employees Provident Fund is a statutory body established by the Employees Provident Fund and Miscellaneous Provisions Act 1952 and is under the administrative control of the Ministry of Labour and Employment Government of India. As an employee if your monthly income is less or equal to Rs. The plan was introduced with the Employees Provident Funds Act in 1952 and is today managed by the Employees Provident Fund Organisation EPFO.

The amount received by an employee in Provident Fund is in a lump sum. Employees Provident Fund EPF is being deducted from your paycheck on a monthly basis but are you curious about how much money you have accumulated in you. Interest for the year 2019-20 has been credited at 85.

Conversely it is up to the employee whether he wants to commute his pension or not in the case of the pension fund. 03092015 Provident Fund works under the Employee Provident Fund Scheme 1952 whereas Pension Fund works under Employees Pension Fund Scheme 1995. The Employees Provident Fund Organization Act and schemes framed there under three board known as Central boadrs of Trustees Employees provident fund consisting of representatives of 1.

The Employees Provident Funds and Miscellaneous Provisions Act 1952 provides for the institution of compulsory Provident Fund Pension 5 Fund and Deposit-Linked Insurance Fund for the benefit of the employees in factories and other establishments. It is administered and managed by the Central Board of Trustees that consists of representatives from three parties namely the government the employers and the employees. 1 This Scheme may be called the Employees Provident Funds Scheme 1952.

Epf Form 11 On Joining A New Job Auto Transfer Of Epf Account

Epf Form 11 On Joining A New Job Auto Transfer Of Epf Account

Employees Provident Fund Epf Benefits Eligibility Forms Registration Process

Epf Scheme Epfo Structure Applicabilty Functions Services Tax2win

Epf Scheme Epfo Structure Applicabilty Functions Services Tax2win

What Is Employees Provident Fund Epf Contribution Rules Benefits The Investors Book

What Is Employees Provident Fund Epf Contribution Rules Benefits The Investors Book

How Can I Check My Epf Balance Online Gadgets Now

Epfo Website Appears To Be Down After Pandemic Advance Facility Announced As Coronavirus Relief Measure Technology News

Epfo Website Appears To Be Down After Pandemic Advance Facility Announced As Coronavirus Relief Measure Technology News

Which Is The Most Beneficial Vpf Or Epf Quora

Eps Employee Pension Scheme Eligibility Calculation Withdrawal

Eps Employee Pension Scheme Eligibility Calculation Withdrawal

Employee Provident Fund Act 1952 Decoded The Hr Chronicles

Employee Provident Fund Act 1952 Decoded The Hr Chronicles

Epf India Epf Claim Eligibility Interest Rate Contribution Payment

Epf India Epf Claim Eligibility Interest Rate Contribution Payment

Epf Balance Check Pf Balance Online

Epf Balance Check Pf Balance Online

Employees Provident Fund Organisation Wikipedia Republished Wiki 2

Employees Provident Fund Organisation Wikipedia Republished Wiki 2

Epf Balance Check Pf Balance Online With Uan Number On Mobile

Epf Balance Check Pf Balance Online With Uan Number On Mobile

Sample Filled Epf Transfer Form 13 Formal Letter Template Letter Writing Template Templates

Sample Filled Epf Transfer Form 13 Formal Letter Template Letter Writing Template Templates

Provident Fund Procedures Problems And Solutions

Provident Fund Procedures Problems And Solutions

Pf Scheme Its Benefits Ppt Download

Pf Scheme Its Benefits Ppt Download

Epf Payment Online Procedure Receipt Download Late Payment Penalty

Epf Payment Online Procedure Receipt Download Late Payment Penalty

Pf Scheme Its Benefits Ppt Download

Pf Scheme Its Benefits Ppt Download